The following payroll tax rates tables are from IRS Notice 1036. The associated 2019 state tax rates or.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

It features the ability to target a specific desired refund amount.

. Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax. The New Jersey State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 New Jersey State Tax CalculatorWe also.

2019 South Carolina Individual Income Tax Table Revised 71119 If your taxable income is. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. 2019 Income Tax Withholding Tables Created Date.

Income Rates Brackets in 2019. Find Fresh Content Updated Daily For Irs tax table for 2019. When using the tax table use the correct column.

Use the 2019 Tax Calculator - 2019 RATEucator - below to get your personal tax bracket results for tax year 2019. Read down the column labeled If Your Taxable Income Is to find the range that includes your taxable income from Form 540 line 19. They can leave their 2019 or prior Forms W-4 and withholding allowances unchanged.

Find Fresh Content Updated Daily For Irs tax table for 2019. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. The tables include federal withholding for year 2019 income tax FICA tax Medicare tax and FUTA taxes. 1004 rows To Find Your Tax.

AT LEAST BUT LESS THAN If your taxable income is. If your taxable income is. Responsibilities and contains the final 2019 federal income tax percentage method and wage bracket withholding tables important updates for 2019 and employer instructions for payroll.

Tax Rate Schedules 2020 and After Returns Tax Rate Schedules 2018 and 2019 Tax Rate Schedules 2017 and Prior Returns You must. Adjust income tax withholding. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

2019 Income Tax Withholding Tables Keywords. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Access IRS Tax Forms.

12102018 14153 PM. Complete Edit or Print Tax Forms Instantly.

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

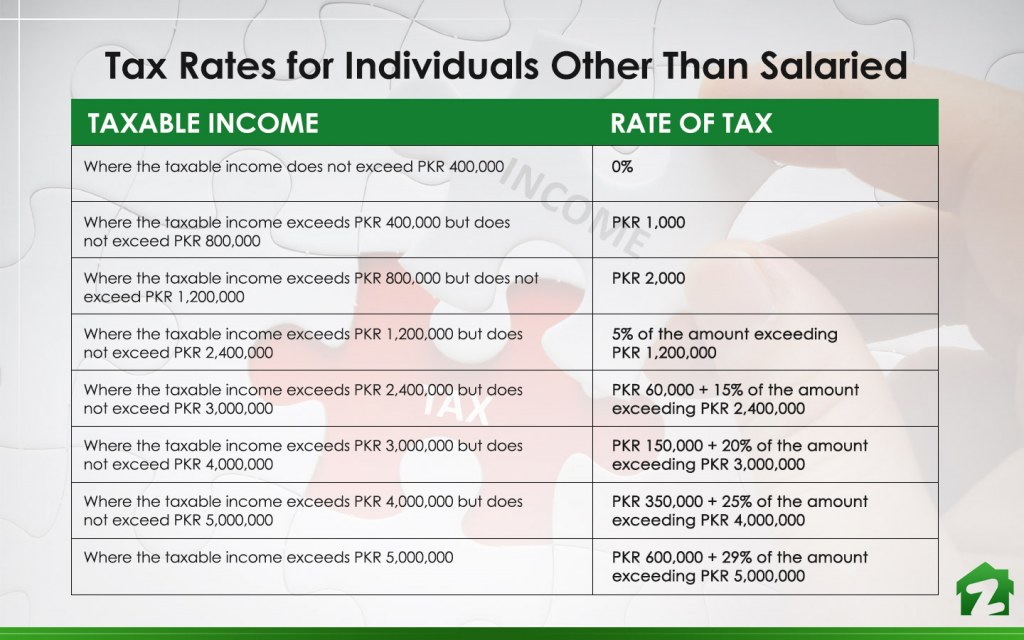

All About Tax Brackets In Pakistan For 2019 Zameen Blog

Excel Formula Income Tax Bracket Calculation Exceljet

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Preparation Income Tax Tax Preparation

2019 Tax Return How Tax Brackets Work Income Tax Brackets Tax Brackets Tax Help

Tax Rate Based On Income For 2019 Roth Ira Investing Strategy Federal Income Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Income Tax In Excel

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Taxtips Ca Business 2020 Corporate Income Tax Rates

Here Are Your New Income Tax Brackets For 2019

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Released New Tax Brackets For 2019 Learning To Do Your Tax Returns Is A Skill That Can Save You A Fortune Over Lifet Tax Brackets Filing Taxes Tax Return

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax